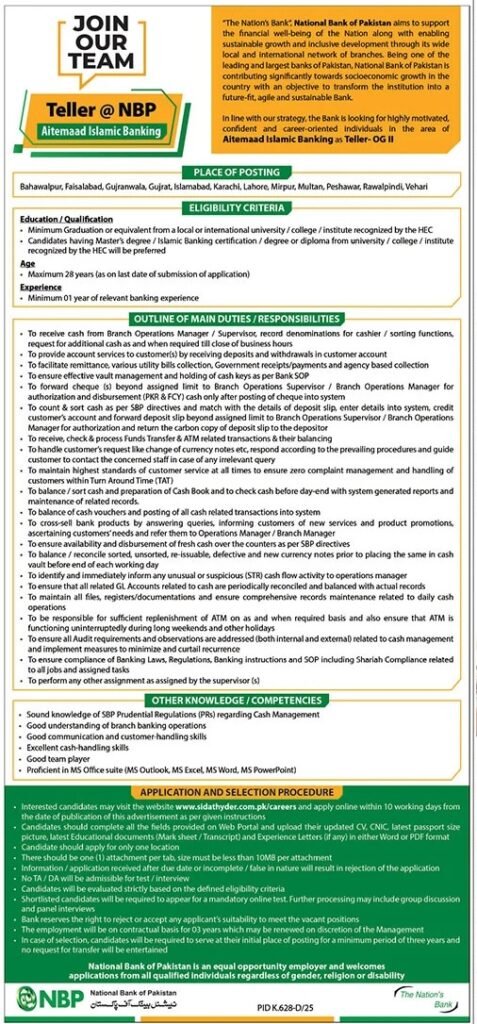

National Bank of Pakistan (Aitemaad Islamic Banking) is hiring confident, service-oriented individuals for Teller – OG II roles across multiple cities. If you’re a graduate with at least one year of banking experience, strong cash-handling skills and a customer-first attitude, this contract role (3 years) offers hands-on branch experience in deposit/withdrawal processing, ATM/FT handling, vault management and cross-selling opportunities — all while maintaining strict Shariah and SBP compliance. Apply online with required documents within 10 working days of this ad (see dates below) — NBP aims for fair shortlisting, an online test and interviews; no TA/DA will be provided.

Job Overview

| Item | Details |

|---|---|

| Ad posted date | August 19, 2025 |

| Last date to apply | September 2, 2025 (10 working days from publication) |

| Job Title | Teller – OG II (Aitemaad Islamic Banking) |

| Place(s) of posting | Bahawalpur, Faisalabad, Gujranwala, Gujrat, Islamabad, Karachi, Lahore, Mirpur, Multan, Peshawar, Rawalpindi, Vehari |

| Employment type | Contractual — 3 years (may be renewed at management discretion) |

| Eligibility | Minimum: Graduation (HEC recognized). Master’s/Islamic Banking certification/diploma preferred |

| Maximum age | 28 years (as on last date of submission of application) |

| Experience | Minimum 01 year relevant banking experience |

| Application mode | Online via Sidat Hyder careers portal: www.sidathyder.com.pk/careers |

| Selection process | Mandatory online test → (may include) group discussion and panel interview |

| TA/DA | None for test/interview |

| PID | PID K.628-D/25 |

Vacant Position — Teller (OG II) (Full details)

Position title: Teller – OG II (Aitemaad Islamic Banking)

Reporting to: Branch Operations Manager / Branch Operations Supervisor

Education / Qualification / Experience

- Minimum Graduation or equivalent from a local or international university/college/institute recognized by HEC.

- Candidates with Master’s degree, Islamic Banking certification/degree or diploma from HEC-recognized institutions will be preferred.

- Maximum age: 28 years (as on last date of submission of application).

- Experience: Minimum 01 year of relevant banking experience.

Outline of Main Duties / Responsibilities

- Receive cash from Branch Operations Manager / Supervisor; record denominations for cashier/sorting functions. Request additional cash as required until close of business.

- Provide account services to customers by receiving deposits and withdrawals into customer accounts.

- Facilitate remittances, various utility bill collections, Government receipts/payments and agency-based collections.

- Ensure effective vault management and custody of cash keys per Bank SOP.

- Forward cheques beyond assigned limit to Branch Operations Supervisor / Manager for authorization and disbursement (PKR & FCY) — cash disbursed only after cheque posting into system.

- Count & sort cash per SBP directives; match with deposit slip details; enter details into system; credit customer accounts; forward deposit slips beyond assigned limit for authorization; return carbon copy to depositor.

- Receive, check & process Funds Transfer & ATM related transactions and perform their balancing.

- Handle customer requests (e.g., change of currency notes) per procedures and refer non-routine queries to appropriate staff.

- Maintain highest standards of customer service to ensure zero complaints and meet Turn Around Time (TAT) targets.

- Balance/sort cash and prepare Cash Book; check cash before day-end with system reports and maintain related records.

- Balance cash vouchers and post all cash-related transactions into the system.

- Cross-sell bank products by answering queries, informing customers of services/promotions, assessing customers’ needs and referring to Operations Manager/Branch Manager.

- Ensure availability and disbursement of fresh cash over counters per SBP directives.

- Balance/reconcile sorted, unsorted, re-issuable, defective and new currency notes prior to placing them in the cash vault before each working day ends.

- Identify and immediately inform any unusual or suspicious cash flow activity (STR) to Operations Manager.

- Ensure all related GL accounts for cash are periodically reconciled and balanced with actual records.

- Maintain all files, registers and documentation; ensure comprehensive records related to daily cash operations.

- Be responsible for sufficient ATM replenishment as required and ensure ATM functionality during long weekends and holidays.

- Ensure audit requirements/observations (internal & external) related to cash management are addressed and preventive measures implemented.

- Ensure compliance with Banking Laws, Regulations, SBP instructions, SOPs and Shariah Compliance for all tasks.

- Perform any other assignments as directed by supervisors.

Other Knowledge / Competencies

- Sound knowledge of SBP Prudential Regulations (PRs) regarding cash management.

- Good understanding of branch banking operations.

- Excellent cash-handling skills and attention to detail.

- Strong team player with good communication and customer-handling skills.

- Proficient in MS Office (Outlook, Excel, Word, PowerPoint).

How to Apply

- Visit www.sidathyder.com.pk/careers and apply online within the application window (see dates above).

- Complete all fields on the web portal and upload the following documents (one attachment per tab; each file < 10 MB; Word or PDF):

- Updated CV

- CNIC (National Identity Card)

- Latest passport-size photograph

- Latest educational documents (mark sheet / transcript)

- Experience letters (if any)

- Apply for only one location. Applications with multiple locations will not be accepted.

- Ensure the application is complete and truthful — incomplete or false information will result in rejection.

- Shortlisted candidates will be notified to appear for a mandatory online test; further processing may include group discussion and panel interviews.

Terms & Conditions

- One (1) attachment per tab; maximum file size 10 MB per attachment; acceptable formats: Word or PDF.

- Applications received after due date or incomplete / false in nature will be rejected.

- No TA/DA will be admissible for test/interview.

- Candidates will be evaluated strictly against the defined eligibility criteria.

- The Bank reserves the right to accept or reject any applicant’s suitability for the position.

- Employment is on a contractual basis for 03 years, renewable at Management discretion.

- In case of selection, candidates must serve at their initial place of posting for a minimum of three years; transfer requests during this period will not be entertained.

- National Bank of Pakistan is an equal opportunity employer and welcomes applications from all qualified individuals regardless of gender, religion or disability.

- Ensure compliance with Banking Laws, Regulations, SBP instructions and Shariah Compliance at all times.